From Trap to Triumph:

Credit That Levels You Up

At Trap N Credit, we do more than just fix your credit — we help you upgrade your entire lifestyle. From removing negative items that hold you back to building a strong credit profile that opens doors, our mission is to put you in position to win. We’ve already helped countless people go from denied applications to approved credit lines, new homes, cars, and business opportunities. Whether you’re starting fresh or ready to take your credit to the next level, Trap N Credit is your plug for financial freedom and long-term success.

I come from the hustle — a real trapper who knew the grind but also felt the setbacks that came with bad credit and limited opportunities. I’ve lived the struggle of being denied, stuck, and overlooked, and I knew something had to change. Once I learned how credit really works, I flipped the game — not just for myself, but for the people around me.

Now I use that same hustle and mindset to help others do the same. Through Trap N Credit, I help people remove negatives, build powerful credit profiles, and unlock the lifestyle they’ve always wanted. My mission is simple: to show that no matter where you start, you can level up your credit, your opportunities, and your entire life.

About Trap N' Credit

We repair & improve your credit scores

Credit Repairing

Credit Consulting

Business Funding*

Trap N' Credit was built on one simple mission: to help people break free from the limits of bad credit and step into a lifestyle they truly deserve. We specialize in removing negative items, repairing damaged credit, and building strong credit profiles that create real opportunities — from home ownership and car approvals to business funding and luxury lifestyle upgrades.

What makes us different is that we don’t just focus on raising scores; we focus on building financial freedom and long-term stability. Our proven strategies have already helped countless clients transform their financial situations, opening doors that were once closed.

At Trap N Credit, we believe your past does not define your future. With the right guidance and powerful credit solutions, anyone can level up their profile, unlock new opportunities, and secure the lifestyle they’ve been working for.

Ferdinand Ramirez

🔑The Perks of a Better Credit Score

A strong credit score isn’t just a number — it’s the key to unlocking opportunities and financial freedom. With a better credit score, you can qualify for lower interest rates, higher credit limits, and better loan approvals for homes, cars, and personal financing. It also opens doors to premium credit cards, business funding, and even impacts insurance rates and rental approvals.

Beyond the numbers, improving your credit empowers you with peace of mind and control over your financial future. It’s the difference between being denied or approved, settling for less or reaching higher, and staying stuck or leveling up your lifestyle. At Trap N Credit, we don’t just help you raise your score — we help you build a foundation for long-term wealth, opportunity, and freedom.

🔑 The Credit Repair Process

Credit Analysis

We start by reviewing your credit reports from all three major bureaus (Experian, Equifax, and TransUnion). This helps us identify negative items, errors, and opportunities for improvement.Dispute & Removal

We challenge inaccurate, outdated, or unverifiable items such as late payments, collections, charge-offs, inquiries, and more. Under the Fair Credit Reporting Act (FCRA), the bureaus must investigate and remove items that cannot be verified.Credit Building

Repairing your credit isn’t enough — we also help you build a strong profile. This includes adding positive trade lines, using the right mix of credit, and teaching strategies to maintain a healthy score.Monitoring & Updates

We track your progress, send follow-ups when necessary, and keep you updated as items are removed and your profile strengthens.Lifestyle Upgrade

As your credit improves, you’ll have access to better opportunities — from approvals for homes, cars, and credit cards to business funding and financial freedom.

Proven Results

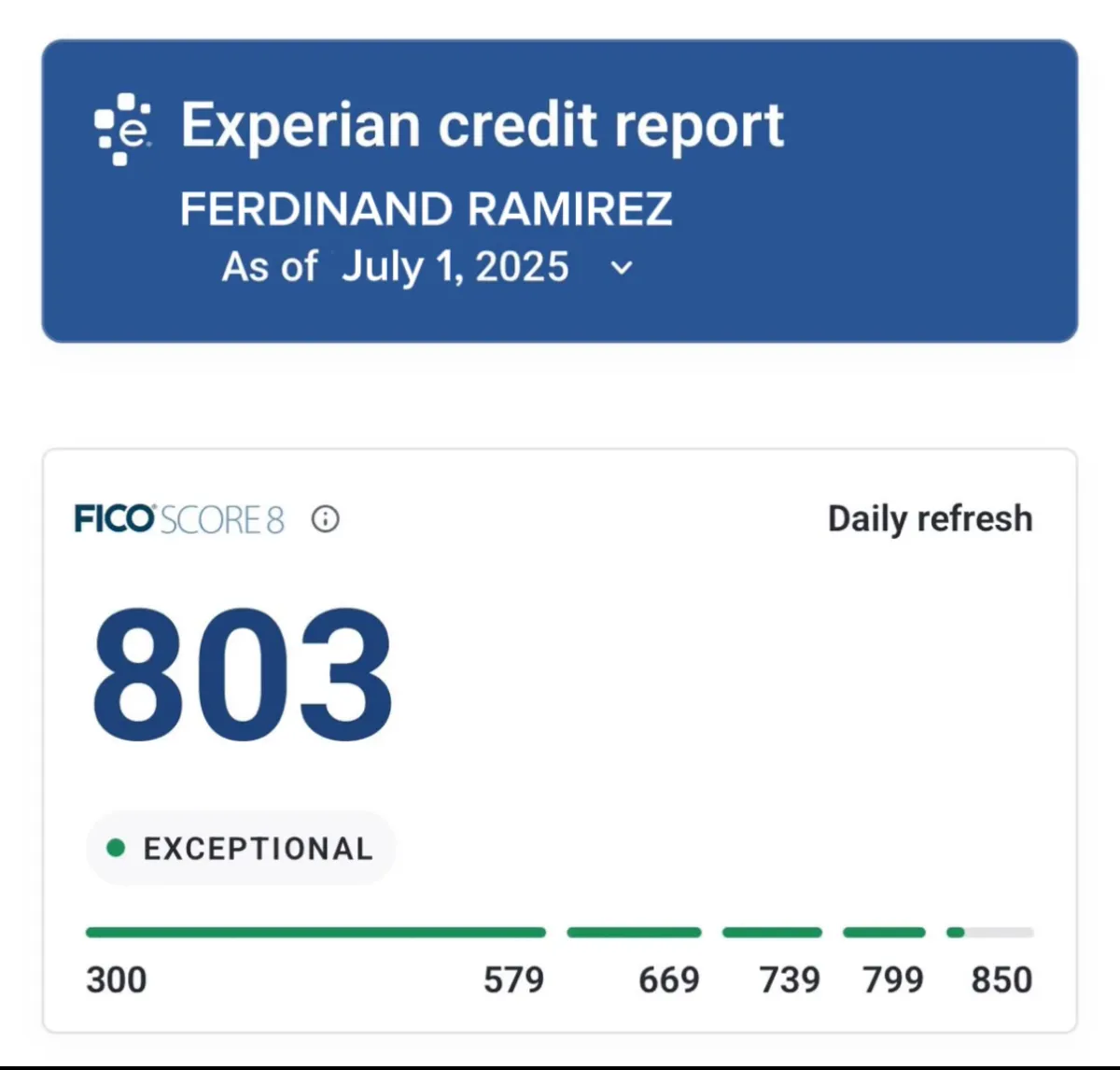

I’ve helped countless clients remove negatives and build strong credit profiles, completely changing their financial trajectory

Real-Life Transformations

My guidance has transformed 40+ lives directly, helping people go from bad credit and denials to approvals, financial freedom, and lifestyle upgrades

Expert Knowledge & Experience

Having been in the hustle myself, I understand the struggle — now I use that experience to teach proven strategies, empower clients, and help them level up their credit and their lives

Lifestyle Impact

Improving your credit isn’t just about numbers — it opens doors to better loans, higher limits, business funding, and long-term financial freedom.

Financial Freedom Starts With Your Credit

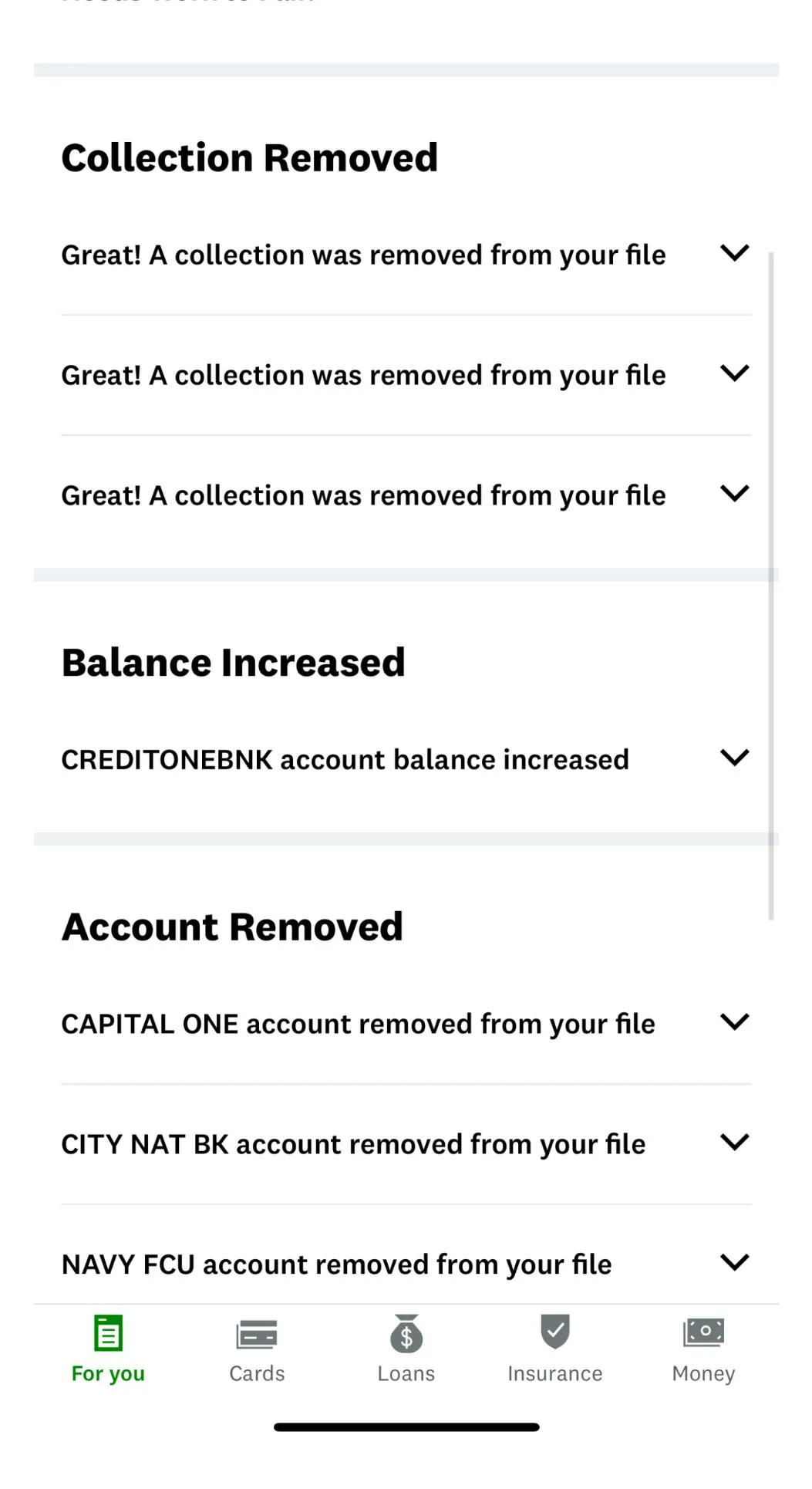

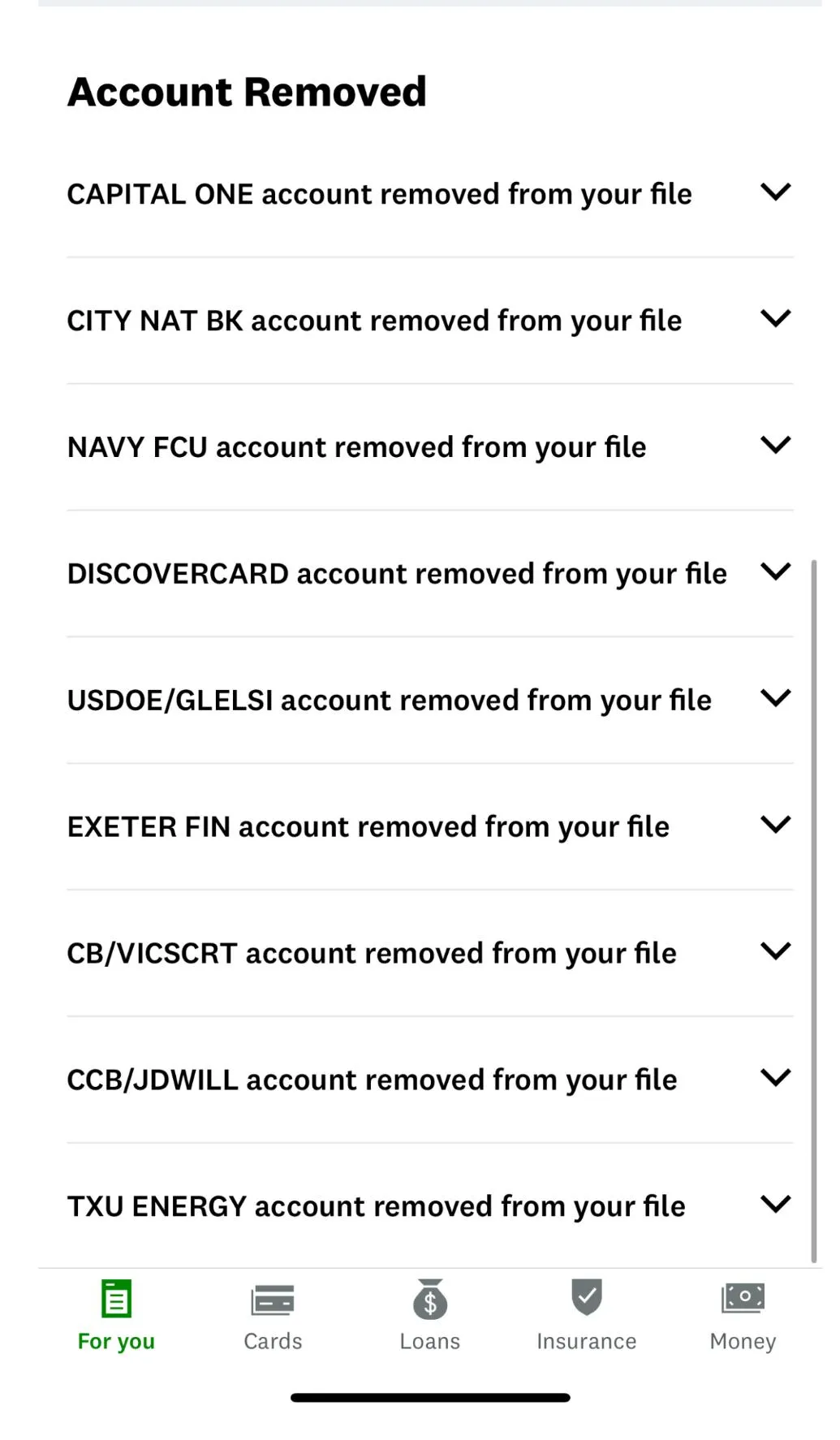

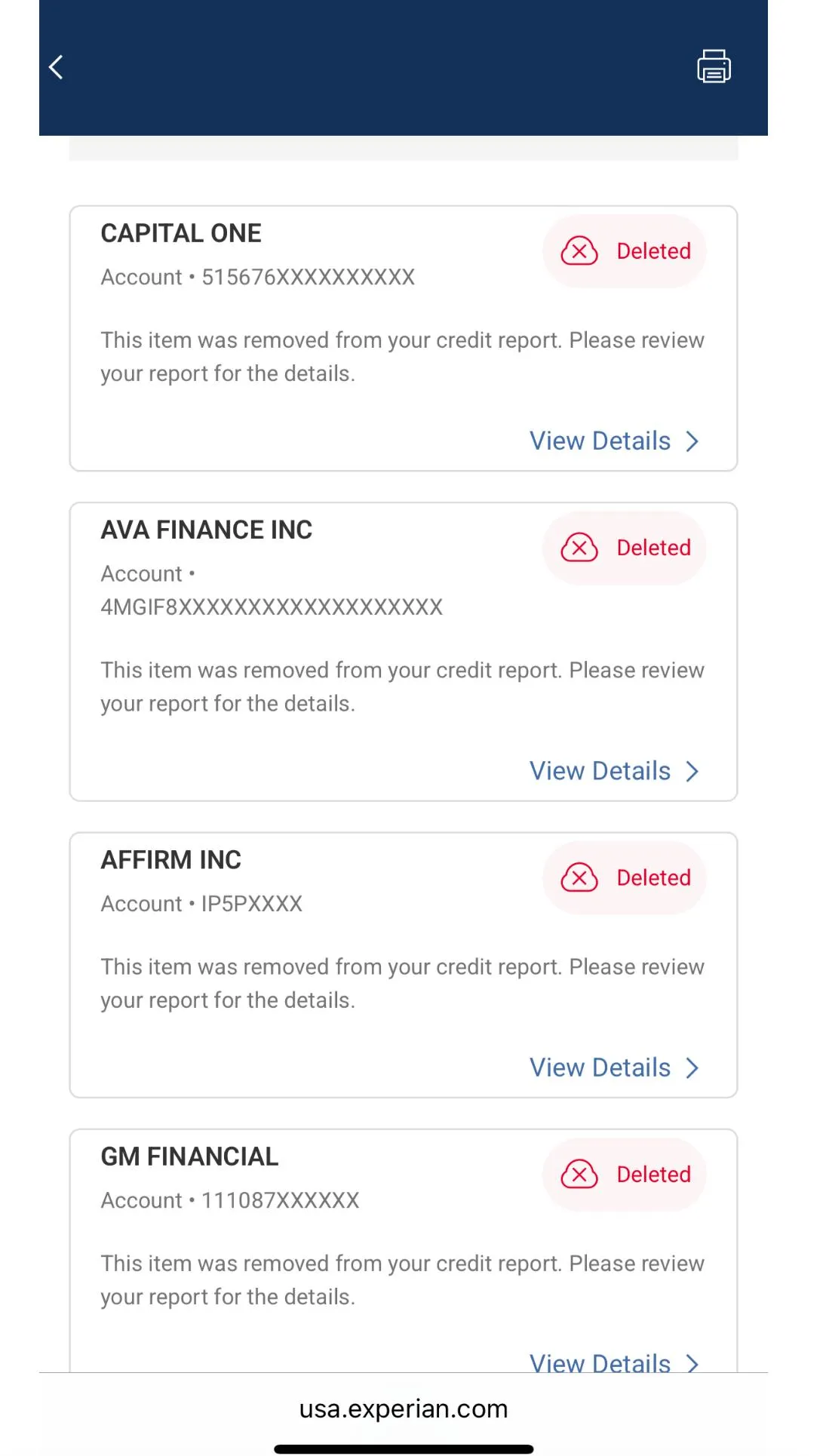

From 400s to 700s — See the Proof!!

1 month

Client #1

7 weeks

Client #2

6 weeks

Client #3

WORK PROCESS

Credit repair works in 4 ease

simple steps

#1

Credit Audit

Review all three credit reports to identify errors, negatives, and opportunities for improvement. Knowing exactly what’s on your report is the first step to taking control.

#2

Dispute Negative Items

Challenge inaccuracies, outdated accounts, and unverifiable information with the credit bureaus to have them removed.

#3

Build Positive Credit

Add responsible credit lines, manage credit utilization, and maintain timely payments to strengthen your profile.

#4

Monitor & Maintain

Track your progress, adjust strategies as needed, and protect your credit to ensure long-term growth and financial freedom.

Case Study: Turning Credit Struggles into Financial Freedom

Client Background:

The client, “J.R.,” came to Trap N Credit with a credit score of 520, multiple late payments, and 8 collection accounts that had been dragging their score down for years. J.R. wanted to qualify for a car loan and eventually buy a home but kept getting denied due to their credit history.

Challenge:

Multiple negative items on credit reports

Unverified collections and reporting errors

Limited understanding of credit building strategies

Solution:

Trap N Credit implemented a comprehensive credit repair plan:

Full Credit Audit: Reviewed all three major credit bureaus to identify inaccuracies and negative items.

Dispute Process: Challenged unverified collections, late payments, and outdated derogatory marks.

Credit Building: Added positive trade lines, optimized credit utilization, and advised on responsible credit usage.

Ongoing Monitoring & Guidance: Tracked progress and provided actionable advice to maintain a healthy score.

Results:

Credit score increased from 520 → 801 in just 2 months

Negative items removed: 3 late payments, 23 collection account

Client approved for a car loan with a low interest rate

Client gained confidence and knowledge to maintain long-term financial health

Client Testimonial:

"Trap N Credit didn’t just fix my credit — they changed my life. I went from being denied for everything to finally getting approved for a car and planning for my first home. Their process works, and they actually care." — J.R.

💳 Why Credit Changes Everything

🚫 The Cost of Bad Credit

Bad credit doesn’t just mean a low score — it means paying more for the same opportunities:

Personal Side:

High Interest Rates: Credit cards may stick you with 24–29% APR. A car loan could double in total cost compared to someone with good credit. A $250,000 mortgage might cost you $100,000+ more in interest over time.

Bigger Down Payments: Apartments often ask for 2–3x rent as a deposit, car dealers want thousands up front, and utility companies require deposits just to turn on service.

Low Limits & Fees: Credit card limits stay low ($300–$1,000) while annual fees and penalties eat away at your money.

Denials & Missed Opportunities: Applications for cars, apartments, travel cards, or even cell phone plans are often denied.

Business Side:

No Access to Funding: Banks deny most applications, forcing you into predatory loans with crazy interest rates.

Higher Costs of Operations: Without business credit cards or lines, you’re using personal cash or high-interest alternatives.

Missed Growth: You can’t scale, hire, or invest because lenders don’t trust your profile.

✅ The Power of Excellent Credit

Strong credit flips the entire game — it’s leverage, freedom, and savings rolled into one:

Personal Side:

Lowest Interest Rates: Qualify for 0–5% APR loans, saving tens of thousands over the life of a car or home loan.

Little to No Down Payments: Move into an apartment with only first month’s rent, lease a car with almost nothing down, and skip security deposits on utilities.

High Credit Limits: Access $10k–$50k+ in credit cards, giving you cushion, perks, and flexibility.

VIP Approvals: Credit cards with cash-back, travel rewards, lounge access, and premium benefits become easy approvals.

Business Side:

Easy Funding Approvals: Banks and lenders open doors — business credit cards, lines of credit, and loans at the best terms.

Leverage to Scale: Use OPM (other people’s money) to invest in inventory, marketing, or equipment without draining personal cash.

Better Vendor Terms: Get net-30, net-60, even net-90 accounts instead of paying cash upfront.

Separation of Finances: Build a strong business credit profile so your personal finances aren’t on the line.

👉 In short:

Bad credit is a weight that makes everything cost more. Good credit is leverage that makes life and business cheaper, easier, and full of opportunity.

Success Speaks!!

“I never thought I could qualify for a car loan after years of bad credit. Trap N Credit not only removed my negatives but also helped me build a strong profile. I’m approved and living my best life!” — J.R.

Trap N Credit completely changed my financial situation. In just a few months, my score went up over 100 points, and I finally got the credit card and financing I needed. Their process works!” — S.M.

“I was skeptical at first, but these guys know their stuff. They audited my credit, disputed the errors, and guided me step by step. Now my credit looks better than it ever has.” — K.L.

Call 808-367-6135

Email:[email protected]